The mining sector has remained underutilized over time and this can be largely linked to the success of the oil and gas sector in the country. However, foreign and local investors are acquiring new mining sites in Nigeria because even though neglected, it surely is a revenue and development gold mine. According to the president of the Miners Association of Nigeria, investments from foreign companies are taking place in the sector right now. This is a result of the attention and interest the sector is getting from the government.

Recently, Symbol Mining, an Australian publicly listed company, commenced mining high-grade zinc and lead in Bauchi State and it has two local Joint Venture projects: Tawny in Nasarawa State and Imperial in Bauchi State, with total tenements spanning over 500km2 (Odinaka A, 2018). According to the CEO of symbol mining, the company commenced operations in Nigeria in 2012 but has recently been expanding operations, completing over 12,000m of exploration drilling. Their major is to generate early cash flow from open-pit mining at the Macy Deposit, which will facilitate further exploration activities at Imperial and Tawny, and potentially expand our resource base to grow the company.

PW Nigeria Limited is currently mining lead and zinc for Symbol Base Metals Limited at their Macy Base Metal project in Bauchi State. This project is fully mobilized and extraction of ore has begun. The company has also acquired a number of licenses majority of which are in Niger state and an exploration program is currently being carried out as stated by the director of PW Nigeria Limited, Martin O’boyle also at the Mining week event.

Another company, Minutor International, which although, identified security as a major challenge of operating in the country is still carrying out a lot of mining activities but can do more. The company currently mines gold, zinc, lead, lithium, and copper in many parts of the country. The managing director, Riaan van der Westhuizen, emphasized the issue of security. He stated that certain areas in the country are inaccessible to exploration crews and this has a direct impact on the speed of development of the solid mineral industry.

Recently, the federal government of Nigeria issued the first-ever gold refining license to Kian Smith Limited. The company’s license came on the back of its participation and presentation at the economic growth and recovery plan (EGRP) Focus Labs and it is breaking ground today on a new Gold Refinery located in Ogun State (Odinaka A, 2018).

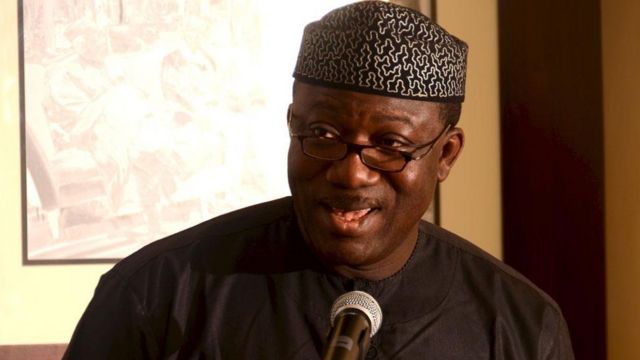

Nigeria has at least 44 known mineral assets that include precious minerals, base metals, gold, iron ore, barite, bitumen, lead, zinc, tin, and coal, among others but the sector is hindered due to a lack of reliable data, state-level governance interference and funding capacity. Small-scale miners often lack funding to operate as they complain of their inability to access funds. About 18 of some 30 steel manufacturers in Nigeria are active and they produce about 2.2 million tons a year leaving the government with a $3.3 billion annual import bill, former Solid Minerals Development Minister Kayode Fayemi mentioned last year.

The government is talking with companies to complete and start production at the Ajaokuta Steel plant. These companies including Russia’s Technopromexport and Ansteel Group Corp. of China. The government is also planning to create a $1 billion mining exploration fund from state and private capital to improve data on Nigeria’s mineral wealth. Each exploration project will be supported with about $5 million. Another aim of the country is to increase mining’s contribution to gross domestic product to 7 percent within a decade, from 0.3 percent in 2017.

The country is definitely going to attract more investment with the actions it is currently making while also trying to increase the participation of artisanal miners in the sector through policies and incentives.

Temitope Toyibat Alimson