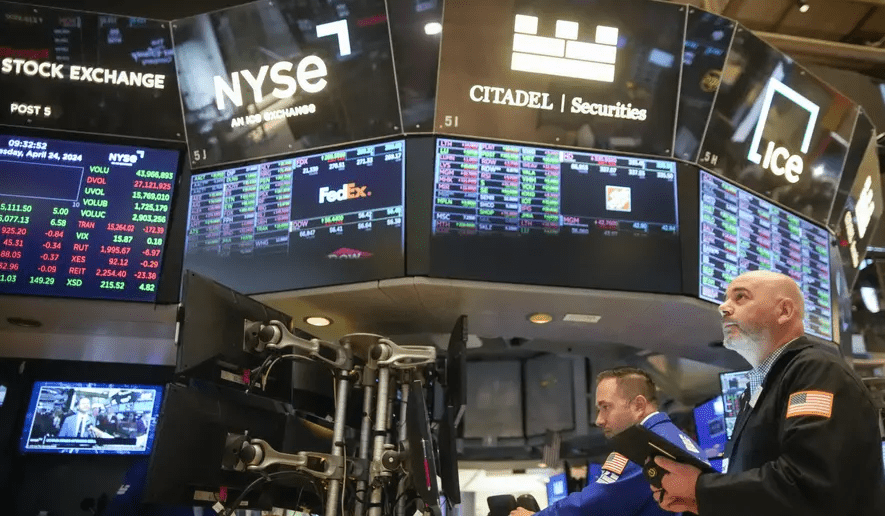

The effects of the increasing trade wars have been felt in various areas of the international market. Among the most worrying consequences is that the U.S. stock markets opened with significant declines, driven by escalating trade tensions and recession fears, which have gripped Wall Street.

The Dow Jones Industrial Average fell approximately 0.9%, shedding 383 points to trade around 42,418. The S&P 500 dropped 1.4%, while the Nasdaq Composite decreased by 2%, according to the Guardian.

This downturn follows a challenging week in which the S&P 500 experienced a decline exceeding 3%, marking its most substantial drop since early September.

Contributing to market uncertainty, China imposed additional tariffs of up to 15% on major U.S. agricultural exports, including soybeans, pork, beef, and seafood, in response to President Donald Trump’s recent 10% levy on all Chinese products. These measures raise concerns about the competitiveness of U.S. farm exports in China and potential inflationary pressures in the U.S.

Further worsening investors’ anxiety, President Trump, in a recent interview, acknowledged the possibility of a recession in the country, referring to the current economic climate as a “period of transition.” This acknowledgment increased fears of prolonged economic instability.

Additionally, Tesla’s stock declined by 5% following a bearish brokerage forecast, adding to the overall negative sentiment in the technology sector. At the close of the day, Tesla was further down by 15% at $222.15, reaching its lowest point since October. This development also confirmed that the company has halved in value since its all-time high recorded in December.

Meanwhile, at the close of business, Dow Jones industrial average slumped further, shedding 890 points or a little over 2% to close at 41,911 points. The S&P 500 index closed at 2.7% lower at 5,614 points. Similarly, Nasdaq dropped by 4%, reaching its biggest daily slump since September 2022 as panic over growth gripped the US market and significantly lowered investor confidence.

These developments emphasise the fragility of global markets amid ongoing trade disputes and economic uncertainty. Meanwhile, with more Trump-induced US tariffs set to kick off, such as the planned 25% tariffs on steel and aluminium imports, heavy tariffs on Europe and some reciprocal tariffs on many other countries, analysts predict a gloomy and uncertain economic outlook, not only for the US but also for the international market.