1. WTO Issues Warning About Trump’s Tariffs, Says It Can Trigger International Trade Reversal

The World Trade Organisation (WTO) has made a U-turn in its previous prediction for international trade.

In a swift move, the WTO sharply downgraded its forecast for global trade, blaming Donald Trump’s aggressive tariff policy, which it warns could seriously reverse trading and damage the global economy.

The WTO had expected global trading of goods to grow by 2.7% in 2025, but now anticipates that it will contract by 0.2%. Similarly, global GDP growth has been revised downward, from 2.8% to 2.2%.

Image credit: BBC

Image credit: BBC

WTO Director-General Ngozi Okonjo-Iweala raised alarm over the increasing rift between the US and China, warning that a sharp fall in trade, which could be up to 91% without tech exemptions, could mark a dangerous decoupling of the world’s two largest economies. According to The Guardian, she described this as “a phenomenon that is worrying” with “far-reaching consequences.”

The US slapped a blanket 10% tariff on imports, with China-facing duties up to 145%, targeting key sectors such as autos and steel. While Trump’s larger “reciprocal” tariffs were paused for 90 days to allow negotiations, following turmoil in financial markets, the WTO warns that reintroducing them could worsen the crisis. If that happens, it would lead to a 0.8% drop in trade, and potentially 1.5% if global policy uncertainty continues to spread.

The WTO says other regions may still post trade gains, but the sharp decline in US trade will drag the global outlook. It may convene an emergency meeting of member states to discuss some pressing issues that require attention.

Trump’s unpredictable tariff declarations—beginning with his so-called “liberation day” announcement on 2 April—have triggered widespread uncertainty, which the WTO says is already weakening business confidence, investment, and future trade growth. The International Monetary Fund (IMF) and World Bank have also cautioned that a tariff war would adversely affect international trade.

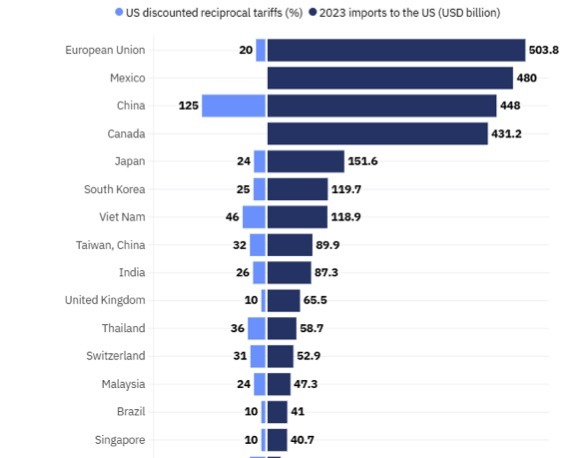

2. Data of the new US tariff regime applied to top importers: what are the worst-hit countries?

US President Donald Trump’s sweeping new tariff regime has rattled global markets and has continued to fuel uncertainty in international trade.

However, many people do not know the percentages of the new tariffs slapped on countries. So, there is a need to look at data relating to these new tariffs applied to countries, the percentages and the countries most affected for a better understanding.

Notably, on April 2, 2025, the US imposed a blanket 10% tariff on all imports, with around 80 countries facing higher duties ranging from 10% to 50%. Trump defended the move as necessary to “balance trade,” a position he had championed throughout his campaign. However, many analysts and foreign governments see the policy as not only economically disruptive but also unfavourable.

Image credit: AFP/Getty

Image credit: AFP/Getty

The announcement sparked a global sell-off, hitting equities and US Treasuries hard. But on April 9th, just as the higher tariffs were to take effect, Trump paused most of them that are above the 10% baseline for 90 days. That decision triggered a market rebound. China, however, will not enjoy such relief, with its tariff rate raised to 125% immediately.

The White House says the tariffs are legal under the International Emergency Economic Powers Act. Exemptions apply to the US-Mexico-Canada (USMCA) nations and key imports like semiconductors, energy, and pharmaceuticals.

Below are the data relating to the new tariffs announced by Trump’s administration and the countries concerned, including the most affected and the least affected nations, according to insights from the World Economic Forum (WEF). While China (125%) tops the list of the worst hit nations, followed by Cambodia (49%), Viet Nam (46%), among others; on the other hand, the UK, Australia, Peru, Brazil, Singapore and other countries only received the minimum 10% reciprocal tariffs.

- Nvidia, Other AI Giants Down After Trump’s Ban

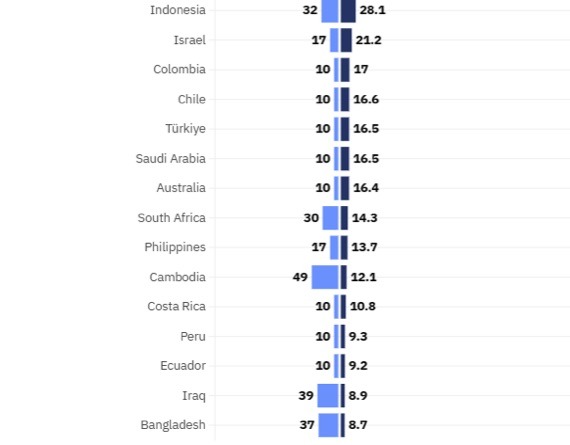

Nvidia has become the major victim of President Donald Trump’s ban on the sale of advanced chips to China.

Speaking on the issue, Nvidia warned that it faces a $5.5 billion financial hit after the Trump administration blocked the sale of its key H20 artificial intelligence chips to China. That development surprised Nvidia’s investors and sent its shares tumbling in the after-hours trading period.

The H20 chip, developed specifically for the Chinese market to meet US export regulations, will now require a special licence to be sold there “for the indefinite future”, according to a regulatory filing released on Tuesday. According to The Guardian, Washington cited concerns that the chips could be used in or diverted to Chinese supercomputers, escalating the tech standoff between the two powers.

Image credit: Business Insider

Image credit: Business Insider

As a result, Nvidia expects to take a $5.5 billion drop in revenue in its current quarter, tied to unsold inventory and unmet sales obligations in China. The announcement wiped around 6% off Nvidia’s share price after markets closed, with billions in market value to be lost in the next market opening.

Nvidia, which has been at the heart of the AI boom and seen its shares surge over 1,400% since 2020, is now facing serious geopolitical hurdles. The news of the chip sales ban triggered a massive sell-off in semiconductor stocks: AMD fell 7% in after-hours US trading, while in Asia, Samsung and SK Hynix dropped up to 3%. Europe’s ASML slumped 5%, missing Q1 order expectations by €1 billion, with its CEO warning of growing macroeconomic volatility.

Though semiconductor firms were initially spared from Trump’s 10% tariffs, further duties are expected to affect them any time soon. Meanwhile, the US Commerce Department has started probing chip and pharmaceutical imports over national security concerns.

- Check out the major long-term economic trends shaping the global economy

The world market is witnessing several changes and challenges, such as technological disruptions, geopolitical tensions, political dominance in the global economic terrain, etc. However, the secret to staying ahead lies in the ability to persevere amid those ups and downs. One way of overcoming the challenges is by being aware of the emerging trends. Going a step further, adapting to these trends is key to thriving in the complex and ever-challenging global trade environment.

While both short-term and long-term trends dominate the market, understanding the long-term trends and making the most of the opportunities they offer is very important to succeed. A recent report by the World Economic Forum (WEF) provided more details about these long-term trends shaping the global economy by getting insights from top economists working in reputable private and public organisations.

So, what are those major long-term economic trends shaping the world economy?

(a) International Trade is changing

The global economy is rooted in international trading. However, international trade is changing in several ways, driven by other factors such as geopolitical tensions, vested interests, and government policies aimed at putting one’s country at an advantage. All these are taking their toll on the global economy, as some of these biased policies, such as tariff regimes as being used by US President Donald Trump, protectionist policies, and others, divide the world market instead of uniting the various countries who were hitherto trade partners working for their mutual benefits based on their comparative advantages. Understanding the evolving nature of international trade and the emerging realities will help any country or entity to adapt and survive.

Image credit: Blackwell Global

Image credit: Blackwell Global

(b) Effect of changing demographics on the workforce

While some regions, such as European countries, are witnessing an increasing ageing population, others, such as Africa and Asia, are experiencing a rise in the active labour force. Many organisations have reported that their operations are affected due to their inability to attract an adequate number of active workers. Another interesting aspect of this trend is the role of skilled workers’ migration (this happens when young talents move from places where they are poorly paid to places where they believe they will have greater opportunities). However, the success rate of such migrations is uncertain due to some processes that make it hard. With a 63% skills gap in the labour market, overcoming the problem of getting an active workforce in some regions is a major issue dominating the world economy.

(c) AI is changing productivity

Technological advancement, especially in Artificial Intelligence (AI), is redefining productivity. According to an earlier report by WEF, AI is projected to add $4.4 trillion to the global economy annually by 2040. This means that AI innovations and trends are too important to be ignored. AI mastery and its application to work can make a big difference in output. Notably, some individuals who were not considered to be very skilled before are getting more equipped with AI and delivering better results than those hitherto called ‘experts’. So, it is no longer just about an individual’s qualifications and experience, but rather, how proficient a worker is in utilising AI can significantly boost the result of that person.

- Did Deepseek Secretly Use Nvidia’s Restricted Chips? US Government Digs Deeper

The US authorities have focused attention on Nvidia in its renewed effort to control advanced chips and stop them from getting into the hands of the Chinese.

The House of Representatives’ China Committee intensified its efforts to probe Nvidia, demanding an explanation over how a Chinese AI company, DeepSeek, gained access to export-controlled American chips. According to FT, the Committee Chairman, John Moolenaar (Republican) and Raja Krishnamoorthi (Democrat), in a letter on April 16, asked Nvidia to clarify its sales in China and Southeast Asia, amid fears that DeepSeek used advanced Nvidia chips to train models that threaten US national security.

Image credit: Firstpost

Image credit: Firstpost

This development is part of Washington’s campaign to curb China’s access to cutting-edge American technology, especially AI-enabling semiconductors. For years, US authorities have steadily tightened export controls to prevent Chinese companies from acquiring hardware with military or surveillance capabilities. The case of DeepSeek is now seen as a potential loophole, with lawmakers alarmed by reports that it accessed Nvidia’s H800 chips, designed for China but later banned by the Joe Biden administration.

Nvidia insists it complies fully with US export laws, claiming it does not knowingly sell restricted chips to China and that its $23.7 billion in Singapore revenue is tied to billing addresses, not end users. However, the US is concerned that chips may be reaching Chinese firms through subsidiaries and partners in third countries. DeepSeek’s ties to tech giants like ByteDance and Tencent, and its data transmission through China Mobile, further fuel fears about espionage and misuse.

Image credit: DWO

Image credit: DWO

The inquiry reinforces Washington’s resolve to prevent US-developed AI technology from advancing Beijing’s ambitions. The US government’s focus on Nvidia indicates a wider strategy to prevent vulnerabilities and enforce stricter controls on the global semiconductor supply chain.