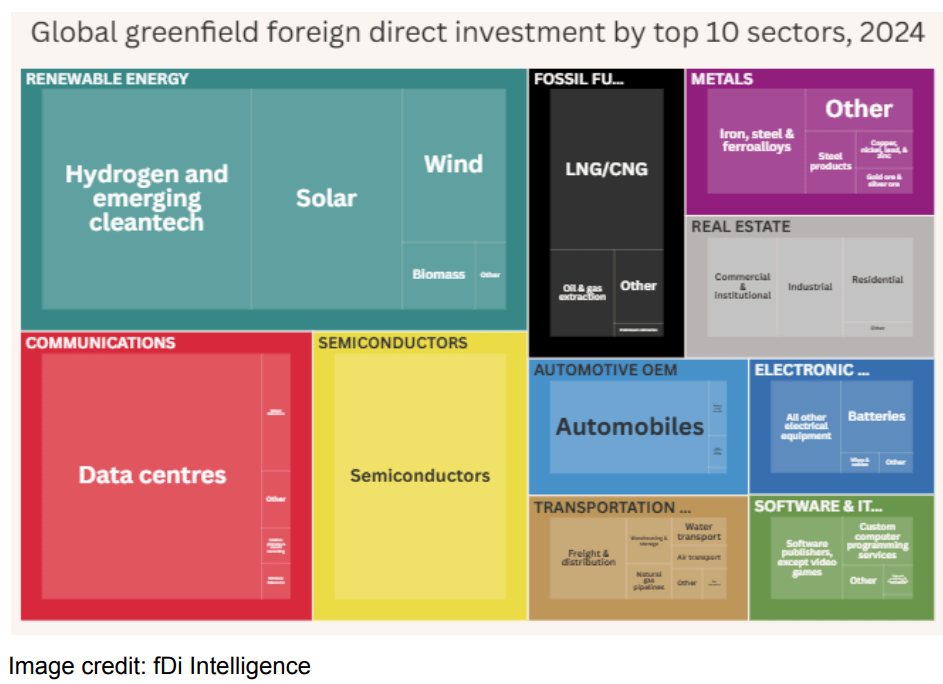

A report has shown how global greenfield Foreign Direct Investments (FDIs)—that is,

FDIs in foreign countries—performed last year across various sectors.

In 2024, global FDIs reached at least $1.23tn, driven by large-scale projects in energy,

technology, and infrastructure. According to fDi Intelligence, renewable energy

remained the top sector, attracting $258bn despite a 30% decline. Also, solar which got

($84bn) did better than wind ($40bn). Investments in Liquefied Natural Gas and

Compressed Natural Gas (LNG/CNG) hit a record $57bn, while oil and gas extraction

FDI fell to $17.5bn.

Data centres saw strong investment growth as they received over $144bn due to rising

demand from Artificial Intelligence (AI) and cloud computing. Semiconductors attracted

nearly $120bn, supported by major subsidy-backed projects across the US, Europe,

Singapore, and Japan. The automotive sector also recorded high FDI, though

investment in battery manufacturing fell sharply to below $20bn from its 2022 high of

nearly $74bn.

On the other hand, real estate, transportation, and metals saw FDI declines, but

software and IT services bounced back and re-entered the top ten. Early data suggests

that mega projects worth $1bn or more remained high at 121, though below 2023’s

record 174. With an average capital expenditure of $77.3m per project, 2024 marked

another strong year for greenfield investments, and this shows a global push towards

digitalisation, energy transition, and strategic industrial capacity.